Market overview

The Library Technology Landscape : Results of the SCONUL Technology Survey 2024

The SCONUL Library Technology Survey provides an in-depth analysis of the technology landscape in UK and Ireland academic libraries, covering 26 functional areas. It serves as a reference for libraries to understand market offerings and improve their technology systems.

- Comprehensive analysis of library technology in the UK and Ireland.

- Covers 26 functional areas with detailed product profiles and assessments.

- Market Complexity and Competition Insight

The survey reveals a complex market with limited competition in certain areas, particularly in Library Management Systems (LMS). This lack of competition raises concerns about value for money and performance. The Library Management System market shows dissatisfaction with value for money and limited competition.

Library systems -UK vendors

See our product directory for a full list of systems suppliers and their full range of systems offered. Listed below are the predominant suppliers to UK HE:

- Education Software Solutions (ESS) - formerly Capita

- Ex Libris (Part of Clarivate)

- Innovative Interfaces (Part of Clarivate)

- ISOxford (Cirqa)

- OCLC

- Open Fifth (formerly PTFS Europe)

- SirsiDynix

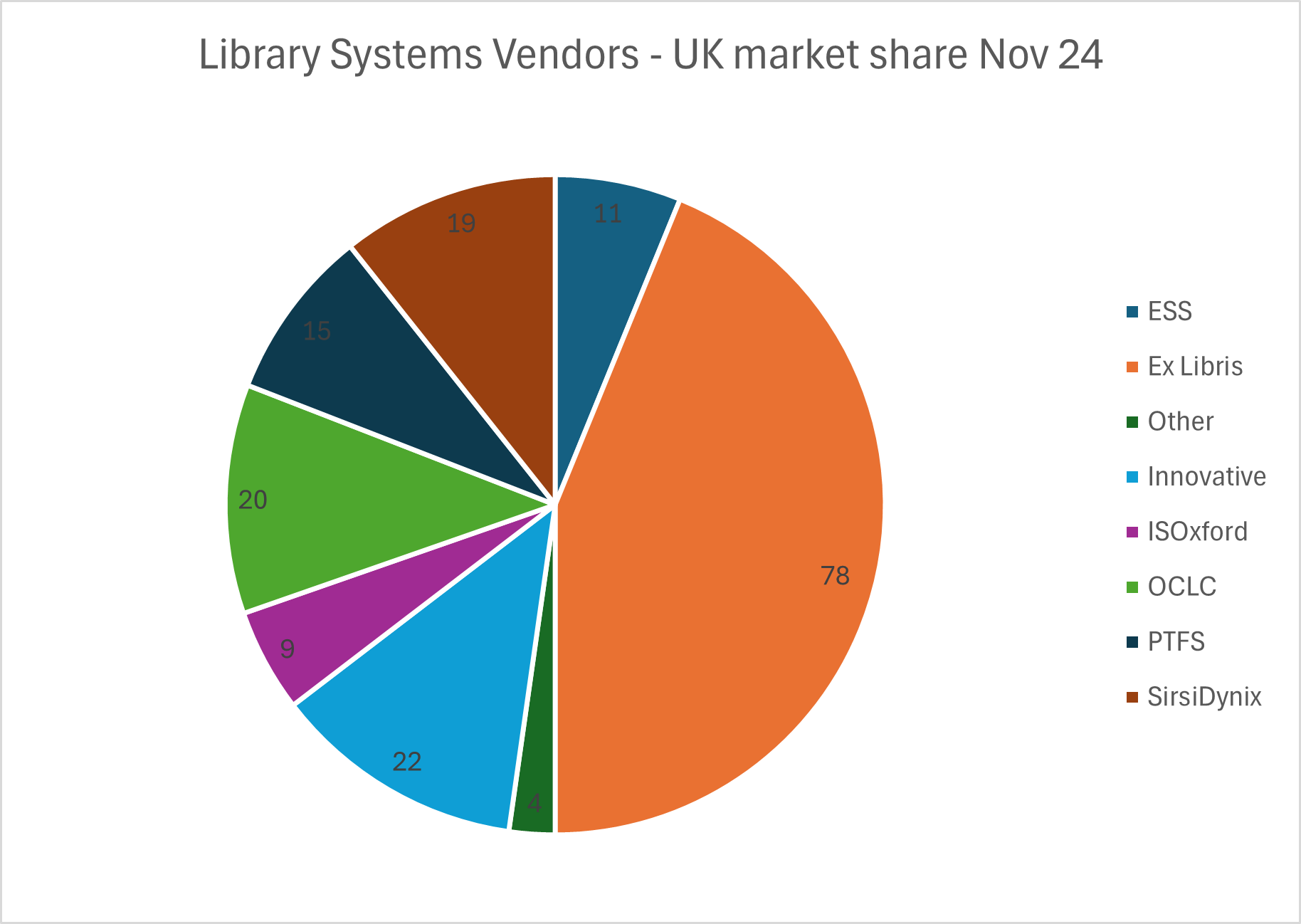

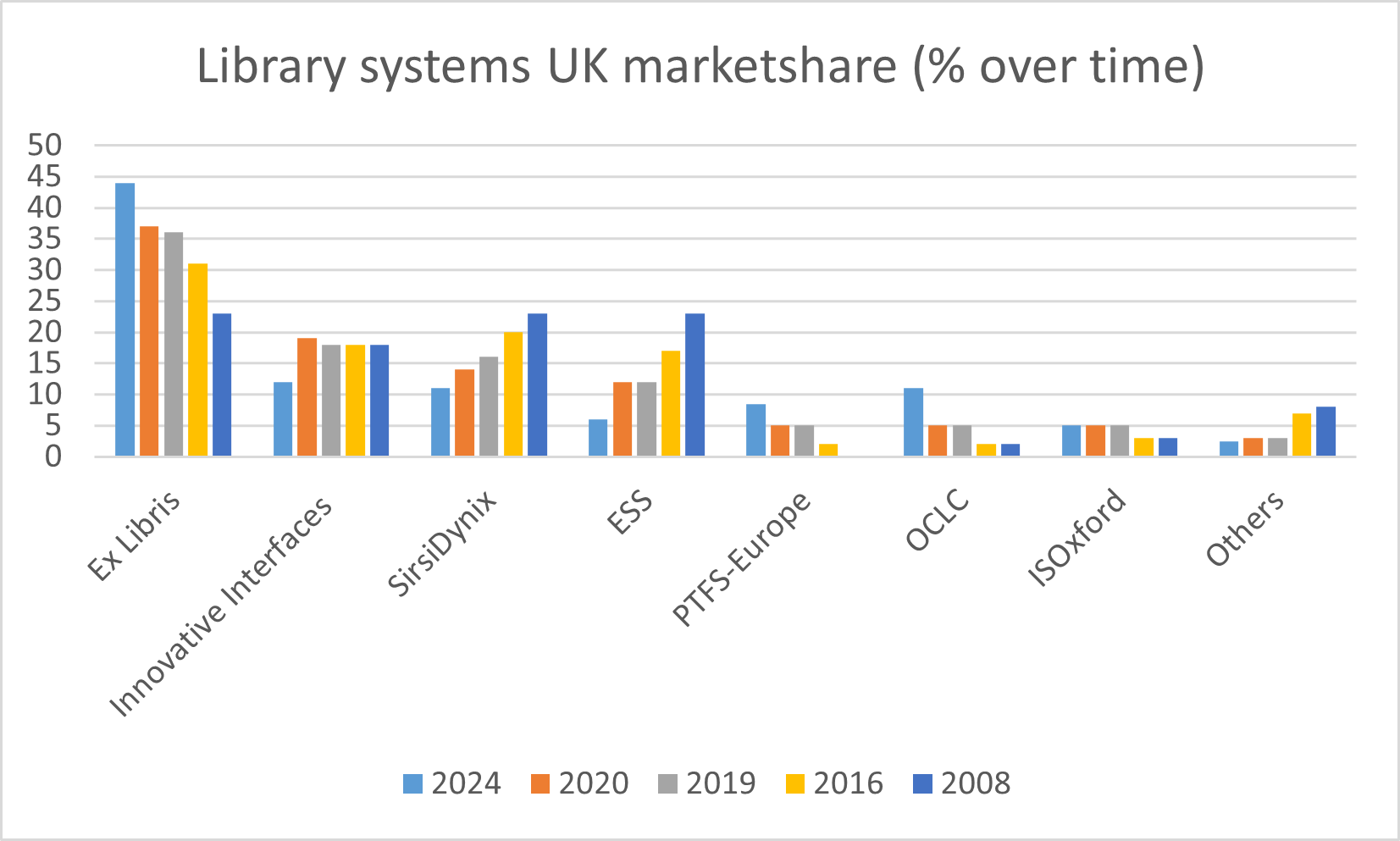

Library systems vendors - market share

See the Who Uses What pages for a list of every UK HE Institution with their library related systems

The US based site librarytechnology.org also provides data on current market share for library systems providers across a range of territories. Data on market share is available here

Use the filters to change country to UK and library type to academic to view UK HE specific data. Note, the currency of the data is not verified and data for specific institutions should be cross-checked against HELibTech data for accuracy.

UK library technology trends and issues

Trends in the library technology market – A UK perspective. Ken Chad. CILIP Buyers Guide. February 2021.

Ken Chad analyses the underlying issues and trends that are shaping library technology with a focus on public libraries and libraries in higher education (HE). It concludes that libraries need new approaches to technology to support changed needs. It addresses themes such as community engagement for public libraries and new solutions for research and teaching and learning in HE. Many current library systems vendors are mired in supporting legacy library management systems that hamper them in delivering the transformative approach needed. Only those that can deliver new higher value solutions will thrive in the longer term.

Global library technology trends and issues

2023 Library Systems Report. The advance of open systems. By Marshall Breeding. American Libraries. 1 May 2023

From the report:

“In recent years, business acquisitions have brought high-stakes changes to the library technology industry, creating seismic shifts in the balance of power. But other events in 2022—primarily advances in open source software—have even bigger implications for the market. Although proprietary products continue to dominate, open source alternatives are becoming increasingly competitive.”

Open library systems – a new perspective. Ken Chad. Higher Education Library Technology [HELibTech] Briefing Paper No. 7, May 2022.

In the last decade or so open source software became a defining factor in how librarians perceived ‘open’ library systems. Open source library systems such as Koha gained market share were often seen in terms of a ‘battle’ with the more common proprietary solutions. With the rise of cloud computing, software ‘platforms’ have come to dominate. Because the solution is hosted in the cloud, rather than implemented on local servers, the underlying technology becomes of less concern. These platforms, including Library Services Platforms (LSPs) typically embrace open source components and combine them with proprietary solutions. The value of a ‘platform’, as opposed to a software ‘product’ comes not only from its own features, but from its ability to connect to external solutions, data and processes.

2022 Library Systems Report. An industry disrupted. By Marshall Breeding 2 May 2022

From the report:

“Events of the last year have reshaped the library technology industry. Previous rounds of acquisitions pale in comparison to the acquisition of ProQuest by Clarivate, which has propelled the leading library technology provider into the broader commercial sector of scholarly communications. This deal signals that the gap in size among vendors is widening, as ProQuest businesses Ex Libris and Innovative Interfaces also join Clarivate.

The emergence of such a large business at the top of the industry has accelerated consolidation among mid-level players that aim to increase scale and efficiency to remain competitive. This was a banner year for consolidation of midsize competitors, with more acquisitions than any prior year.

These deals raise concerns about weakened competition, but they may also enable new industry dynamics that will spark innovation and synergy within the broader research and education landscape. Small companies with visions for innovation often lack the resources to deliver, which larger companies can provide. Increased investor and stockholder involvement, however, translates into pressure to maximize profits and growth. The way these competing dynamics play out has important implications for libraries.

Some disruptions happen more gradually. Library management systems based on open source software show steady growth. Koha, especially when supported by ByWater Solutions, continues to make inroads among US public and academic libraries.

2021 Library Systems Report. Advancing library technologies in challenging times.

By Marshall Breeding 3 May 2021

From the report: “Solidifying a consolidated industry

Business acquisitions spanning multiple decades have consolidated the library technology industry into one dominated by a handful of large companies. Organizations such as EBSCO Information Services, Follett, OCLC, and ProQuest have assembled diverse portfolios of products, some of which complement other content offerings and services not covered in this report. These organizations are massive: EBSCO Information Services employs 2,852 globally. Across its businesses, ProQuest has a workforce of 2,740—including 1,461 employed at the parent company and the rest via subsidiaries including Bowker, Ex Libris, and Innovative. Follett, with $3 billion in revenue in 2020, employs 1,758 (including its subsidiaries). OCLC reports 1,238 total personnel. The remaining organizations that participated in this report employ a combined total of 1,316 people, reflecting the economic clout of the top tier.”

2020 Library Systems Report Fresh opportunities amid consolidation

By Marshall Breeding American Libraries 1st May 2020

“The library technology industry took some significant turns in 2019. Ex Libris, a ProQuest company, acquired Innovative Interfaces and shifted the balance of power, strengthening Ex Libris’ position in technology for academic libraries and propelling it as a major player in public libraries. This move narrows the slate of competitors in an industry already offering few viable options for many libraries”.

See also Marshall Breeding’s Library Technology Guides dashboard which brings together data, trends, news, and other resources.

HELibTech Who Uses What Library Technology

You can also find out more detailed information about which institutions are using which products by visiting the Who Uses What section of the site

Section updated September 2025